Accurate financial reporting in WooCommerce depends on feeding the right data into your system. That’s why the Data Settings in the ProfitBlue plugin are so important. By configuring costs, income, and taxes correctly, you ensure that your profit and loss reports reflect reality — not just estimates.

This guide walks you through each section of the ProfitBlue Data Settings and shows you how to set up your WooCommerce store for precise profit tracking.

Overview of Data Settings

The Data Settings page in ProfitBlue contains five main sections:

- Custom Costs & Income

- Cost of Goods Sold (COGS)

- Shipping Costs

- Payment Fees

- Shop Settings (Tax on Income)

Each one plays a role in calculating the real profit margins of your WooCommerce store.

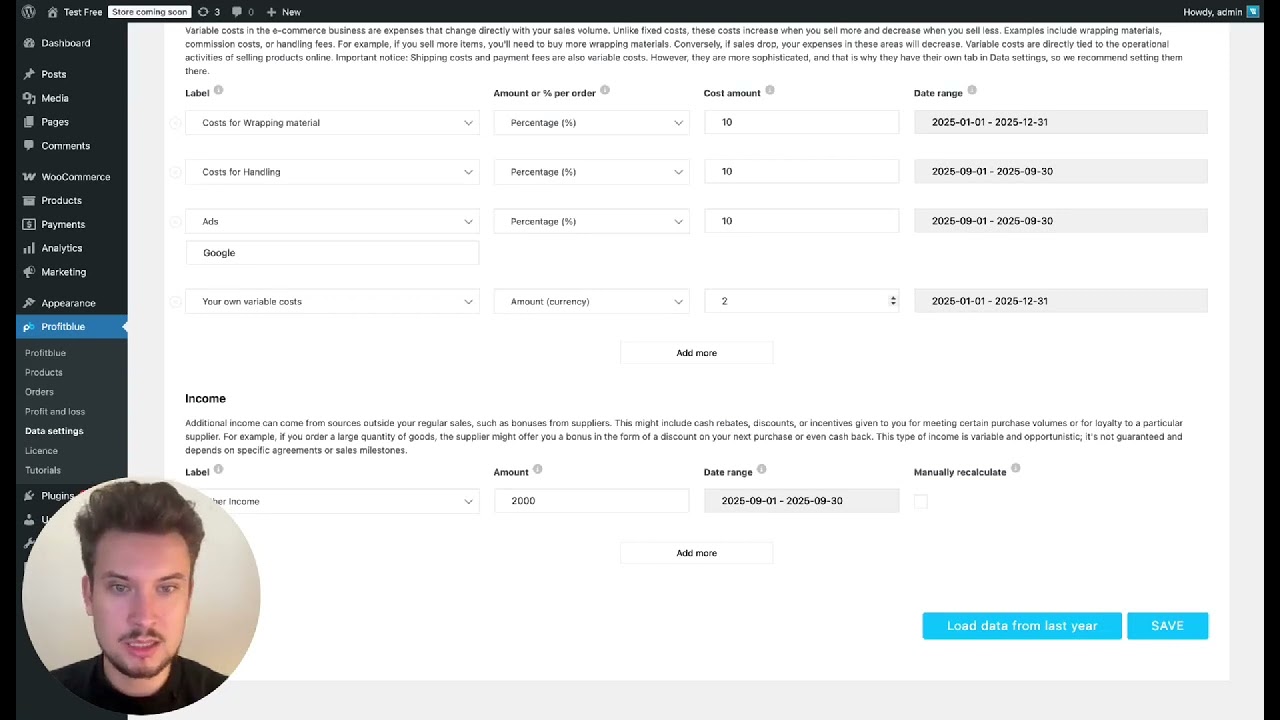

Custom Costs & Income

This section allows you to add three key financial elements:

- Fixed Costs – Expenses that stay constant regardless of sales. Examples: office rent, hosting fees, salaries, or licenses.

- Variable Costs – Costs that scale with revenue or order volume, such as packaging, ad spend, or handling fees. You can set these as a percentage of revenue or as a fixed amount per order.

- Income Adjustments – Additional income sources like supplier bonuses or rebates that supplement revenue.

Example Setup

- Add office rent as a fixed cost: $1,000 per month.

- Add payment handling as a variable cost: 2% of revenue.

- Add a supplier rebate as income: $100 per year.

ProfitBlue automatically spreads fixed costs across months, scales variable costs with sales, and adds income to your P&L reports.

Cost of Goods Sold (COGS)

COGS is one of the most critical inputs. It represents what you pay suppliers for each product you sell.

- Enter COGS manually for each product.

- Or bulk import/export via Excel (available in the Pro version).

Without COGS data, your profit calculations will be incomplete, so setting this up should be your first priority.

Shipping Costs

ProfitBlue gives you flexibility in how to set up shipping costs:

- No Shipping Costs – All shipping costs are set to zero.

- Same as Customer Fees – Costs match what customers pay for shipping.

- Custom Fixed Costs – Enter a fixed cost that differs from what customers are charged.

- Variable Percentage – Assign shipping costs as a percentage of order revenue.

This ensures that your reports capture whether shipping is a profit center, a breakeven, or a loss driver.

Payment Fees

Payment gateways like Stripe, PayPal, or bank transfers usually take a cut from each transaction. In this section, you can:

- Enter percentage-based fees (e.g., 1.5% of revenue).

- Add fixed fees per transaction (e.g., $0.30 per order).

ProfitBlue then applies these fees automatically to your orders in real time.

Shop Settings: Tax on Income

Finally, set your corporate income tax rate so that ProfitBlue can calculate net profit accurately. This is different from VAT/sales tax — it’s the tax on your actual profit. Enter the rate (e.g., 10% or 20%) and it will appear in your Profit & Loss reports.

Why Data Settings Matter

Correctly setting up your Data Settings is the foundation of reliable WooCommerce profit reporting. With accurate inputs, you can:

- Trust your P&L numbers.

- Make informed decisions about pricing, advertising, and costs.

- Identify where profit leaks occur (shipping, fees, or supplier costs).

- Plan for growth with a clear understanding of net profit.

Final Thoughts

The ProfitBlue Data Settings may require some initial setup, but the payoff is huge. Once configured, every order and every product in your WooCommerce store will reflect real-world profitability.

By combining fixed costs, variable costs, COGS, shipping, fees, and taxes, you get the complete picture of your business health — helping you act faster and grow smarter.